Third-Party Risk Demands First-Priority Attention

Third-party collaboration has evolved into a necessity for most businesses in today’s market. However, the challenges of managing third-party risk programs can be overwhelming.

This article will cover how business leaders can address their third-party risks by providing an overview of the third-party oversight landscape, regulatory obligations, key implementation challenges & solutions.

Overview of Third-party Risk Management Programs

Third parties which are often referred to as vendors or suppliers can be defined as business entities or individuals that provide products or services directly to an organization or its customers on the organization’s behalf.

Third-party risk management programs (TPRMs) help businesses select the right third parties that can help them meet business objectives while protecting their data. Implementing an effective TPRM also drives compliance throughout an organization’s ecosystem.

Regulatory Compliance Landscape

Third-party risk management is required in many industries. Organizations handling sensitive and protected information will often be required to comply with one or more regulations.

Some example of regulations, standards and frameworks requiring management of third party risks include:

- CCPA

- HIPAA Final Rule

- HITRUST

- MA data security lawISO 27001

- GDPR

- PCI

Still, effective risk management is still lagging, evidenced by the hundreds of data breaches and ransomware attacks happening every year caused by ineffective control and security standards.

Our interconnected business landscape means one company’s data breach could become your headache.

Challenges

Organizations often face difficulties establishing and maintaining a TPRM due to several internal challenges including:

- Adoption: Due diligence delaying business initiatives.

- Program effectiveness: Lengthy questionnaires are often not acted on by the due diligence teams.

- Scalability: The need for third-party services grows faster than internal program resources.

- Legacy vendors: Without contracts and proper security protection.

Although there is a margin for error when it comes to the complexity of third-party risk management, there are simple solutions that can help executives sleep better at night, knowing they are proven to be effective at mitigating third-party risk!

Solutions

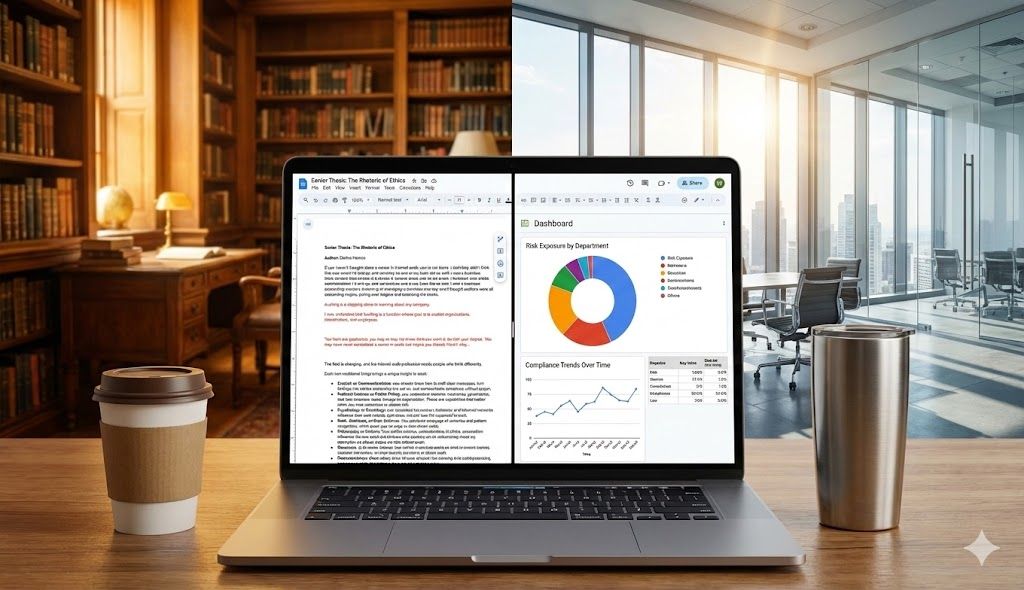

The secret to successful third-party risk management programs: data-driven due diligence and monitoring programs that tie to your resilience and enterprise risk management program.

Data collected through a solid due diligence program

will become a critical asset for your AI systems to better predict risks associated with third parties and recommend sound decisions.

1. Due Diligence

- Develop a cross-functional program with representation from various relevant teams in the organization.

- Centralize the due diligence process (one-stop shop for business owners).

- Focus your due diligence process on vendors that “touch” your critical data, not every vendor in your procurement system.

- Use a tiered risk approach, as the risk level associated with the vendor should determine the review effort.

- In the early stages of your due diligence program, establish short and concise due diligence compliance questionnaires.

- Based on the due diligence results, incorporate key security, resilience, and audit terms in the contract phase.

Tips to improve the vendor questionnaires

2. Business Continuity Planning (BCP)

- Tie the vendor due diligence stage with your disaster recovery and BCP program to identify all new vendors that might impact your program

- Capture their Recovery Point Objective and Recovery Time Objective commitments before signing the contract.

3. Monitoring

- Consider quarterly performance monitoring.

- Implement an annual compliance Review

4. Enterprise Risk Management

- After the due diligence and monitoring phases, tie the third-party observations and remediations to your risk register to keep your risk profile up to date.

- With time, the risk data will be useful to predict which third parties to engage and retain in your supply chain database.

5. Reporting

- Regular reporting shouldn’t fall by the wayside! It’s important to formalize reporting on several key performance indicators as well as outline progress, current and ongoing risks and flag any pertinent issues to management and the Board.

Critical vendor contract terms

It’s not too late to implement your program

By properly implementing a third-party risk management program with the right oversight in place, companies can strike a healthy balance between regulatory compliance and business owner satisfaction.

If your company needs TPRM services, AdviseUp can help. We are an audit, risk, and compliance consulting firm that goes beyond checking the compliance box.

Start preparing your business for the future, today.